Auto Loan Payoff Calculator: Save Money and Get Debt-Free Faster

Meta Description: Discover how an auto loan payoff calculator helps you save thousands on interest. Learn to use an auto payoff calculator and make smart additional payment calculator auto decisions today.

Table of Contents

TogglePaying off your car loan early sounds great, right? But figuring out the actual savings can feel overwhelming. That’s where an auto loan payoff calculator becomes your best friend. This simple tool shows you exactly how extra payments impact your loan. You’ll see your potential savings in minutes, not hours of confusing math.

An auto payoff calculator takes the guesswork out of early repayment. You enter your loan details and boom—instant answers. It shows how much interest you’ll save with extra payments. Most importantly, it reveals your new payoff date. These calculators make smart financial decisions surprisingly easy.

What Is an Auto Loan Payoff Calculator?

An auto loan payoff calculator is a free online tool. It helps you understand your car loan better. You input basic information about your current loan. The calculator then shows you different payoff scenarios instantly.

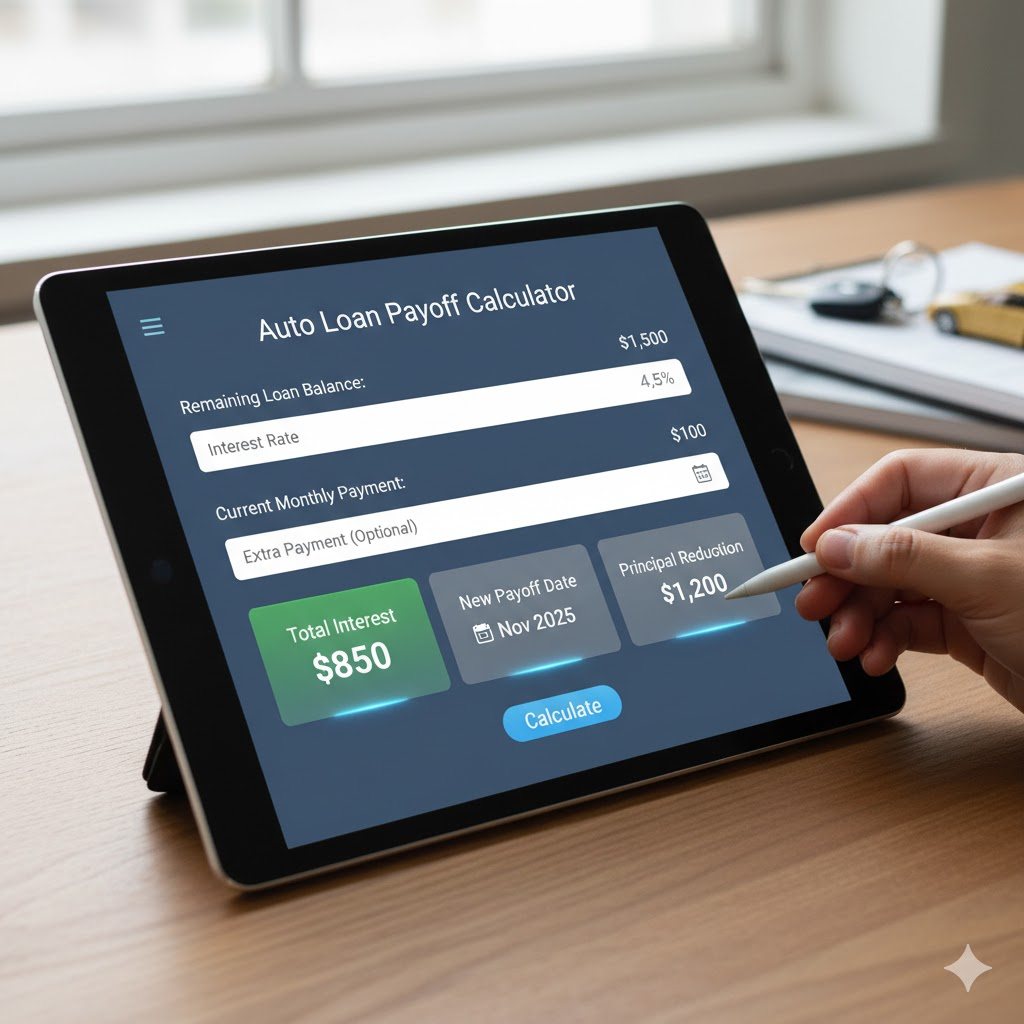

These calculators require just a few simple details. You’ll need your remaining loan balance and interest rate. You also enter your current monthly payment amount. Finally, add any extra payment you’re considering making. The tool does all the heavy lifting for you.

The auto payoff calculator provides valuable insights immediately. You see how extra payments reduce your principal balance. It calculates your total interest savings over time. The calculator also shows your new loan payoff date. This information helps you make confident financial choices.

Why Use an Additional Payment Calculator Auto Tool?

Paying extra money on the auto loan saves actual money. But how much exactly? That’s what an additional payment calculator auto tool reveals. Before committing yourself to a certain payment, you can give it a test run. This saves you money-saving mistakes and gives you the most savings that are possible.

The interest build up is quicker than many individuals can imagine. Your monthly rate will include payment of principal and interest. At the beginning of your loan you spend most as interest. Additional payments are directly to your principal account. This saves you an enormous amount of interest.

An auto loan payoff calculator shows multiple scenarios side by side. You can put an additional 50 dollars monthly to the test. Or perhaps you are thinking of a single lump amount payment. The calculator analyses all alternatives in a short time. And you will know which approach will cost you the least.

Money in the bank is a fantastic feeling, and these calculators can help one get it faster. Making early payments on your car liberates monthly earnings. You have the ability to divert that money on other objectives. It could be saving, investing or paying up other debts. The auto payoff calculator is used to plan this schedule.

How to Use an Auto Loan Payoff Calculator Effectively

Using an auto loan payoff calculator is surprisingly straightforward. The first thing to do is to start by getting your existing loan data. Have a close check at the latest loan statement. Powerful numbers make you have the best results.

Input the balance in your existing loan into the calculator. That is what you owe nowadays. Then key in your interest rate per annum in percentage. Then add your usual amount of monthly payment. Approximately, the majority of the calculators require your initial loan term as well.

The testing of the additional payment scenarios comes now. It should be an additional hundred dollars a month. The additional payment calculator auto instantly recalculates everything. You will be able to see your new payoff date and savings. Experiment with the various quantities to see what works.

Consider the outcome then proceed and decide. Current payments The calculator will give your total interest. It shows interest on your additional payments also. The comparison of these figures is what you have really saved. This does make the decision-making much easier.

Some auto loan payoff calculator tools offer advanced features. They could demonstrate amortization schedules or graphs. These images assist you in having an insight into the breakdown of payments. Search calculators that can compare scenarios of you. This aspect is very supportive in strategic planning.

Benefits of Paying Off Your Auto Loan Early

There is no better thing in the world than paying a car loan early. To begin with, you will save on interest. This may amount to thousands of dollars. An auto payoff calculator shows you exactly how much.

The earlier you are out of debt, the less financial stress you will have. You will have extra space in your budget. That car installment is removed off your pocket. And then you just have money to save or invest.

Angelic early repayments may bring about an improvement in your credit score. The less your overall debt amount, the better your credit utilization is. Nonetheless, the loan is closed to eliminate an active account. The effect is positive; although it depends on the kind of debt decreased.

It is a true peace of mind when you own your own car. You will not think about repossession in case it becomes difficult to make both ends meet. It really is your car and there are no attached strings. Also, you may change your insurance cover possibly. A great number of them reduce insurance payments after the loan is repaid.

Using an auto loan payoff calculator helps you plan strategically. Early payoff can be offset against other financial targets. Perhaps you would want to establish an emergency fund at the same time. The calculator assists you in the appropriate trade off. It depicts realistic schedules depending on your real budget.

Common Mistakes to Avoid When Paying Extra

There are numerous avoidable errors with early payoffs of loans. To start with, never overlook any prepayment penalty of your loan. Other lenders impose charges on early loan payment. An auto payoff calculator won’t catch this detail automatically. Extra payments are made when your loan agreement has been read thoroughly.

And never use your emergency funds to pay down debt. Financial specialists suggest having three- six months savings of expenses. Your emergency fund insures against the unforeseen expenses. Medical expenses, auto maintenance or unemployment may occur. Wear that safety net and pay an extra amount.

Ensure that extra money is made on your principal balance. Increase in money in future fees may be done by some lenders instead. This does not cut your interest in a bit. Check with your lender on the policy of paying extra. Ask that additional payments bring down your principal in-the-spot.

Another mistake is the neglect of the higher-interest debt. Interest rates that are charged on credit card debt will oftentimes be much higher. In case you have balances in your credit cards, then focus on them first. An additional payment calculator auto tool can’t tell you this. All the interest rates of your debts should be compared.

Do not forget the opportunities of investments as you concentrate on debt. There are cases when investing returns are more than your interest rate on the loan. In case when your employer has a 401k match, contribute enough to receive it. You are not supposed to leave that free money behind. Repay the debt in balance with retirement savings.

Smart Strategies for Extra Auto Loan Payments

Begin with very little money when you are new at this additional payment. Even twenty-five dollars a month is a difference. Use an auto loan payoff calculator to see the impact. Minor wins foster confidence and give strength with time.

Include the payment made every month to the closest hundred. Suppose you are paying three hundred and thirty five dollars, then half a moment and make it four hundred. This mental game causes additional payments to perform automatically. That is hardly reflected in your budget. However, savings accumulate to huge compensation within the loan term.

Use windfalls on the balance of your auto loans. Faultless tax refunds, work bonuses or gift money are ideal. These lump sums give enormous holes in your principal. An auto payoff calculator can show you the exact impact. With those interest savings building up, you will get encouraged.

Establish bi-weekly payments rather than monthly. You will pay twenty-six half-payments, not twelve full payments. This is an automatic payment of thirteen complete payments per year. This change in the payment structure is barely noticed even by most people. It however helps you achieve a payoff in the shortest time with little struggling.

Make yourself some extra payments, which would be regular every month. Automatic transfers Out of your checking account. This eliminates the urge to do away with a month. Consistency is key when using an additional payment calculator auto strategy. This discipline will be appreciated in the future by yourself.

Finding the Right Auto Loan Payoff Calculator

Many websites offer free auto loan payoff calculator tools online. The calculators are available in banks, credit unions, and financial websites. Find the tools that are simple to comprehend. The superior calculators are transparent and give detailed results in real-time.

Use calculators which display full amortization schedules where possible. Such schedules disaggregate all the payments at a time. You can see just what you go to principal and what you are interested in. This disclosure will make you know your loan better. It further encourages you to pay an additional amount of money.

Some auto payoff calculator tools offer mobile apps too. These applications allow you to calculate anywhere. You are able to visit various scenarios anywhere any time it is convenient. Compared to budgeting, mobile calculators are ideal in an instant comparison. Only make sure that they come with good sources of finance.

Research reviews first before giving your order to any calculator. Use products of a reputable bank/financial institution. There are calculators provided by the government websites such as the Consumer Financial Protection Bureau. These are credible sources and are updated with current information every time.

Compare a number of calculators to ensure that your results remain the same. Different tools may indicate a few numbers slightly different through rounding. The general savings will be very comparable though. In case you get wildly different results, check what you are entering. It is important that the decision should be accurate regarding a big financial decision like this one.

Taking Action With Your Auto Loan Payoff Calculator Results

After using an auto loan payoff calculator, it’s time to act. Review your budget honestly to find extra payment money. Look for expenses you can reduce or eliminate temporarily. Even small cuts add up to meaningful loan savings.

Contact your lender to understand their extra payment process. Ask specifically how to ensure payments reduce your principal. Get their policy in writing if possible for protection. Some lenders require special instructions with each extra payment. Knowing this prevents frustrating mistakes down the road ahead.

Start with an amount you can sustain comfortably long-term. Consistency beats occasional large payments in most scenarios. An additional payment calculator auto confirms this pattern works best. You’re building a habit, not sprinting to the finish.

Track your progress monthly to stay motivated and committed. Watch your principal balance decrease with each extra payment. Celebrate milestones like reducing your balance by certain amounts. These small celebrations keep you engaged with your goal. Consider using apps or spreadsheets to visualize your progress.

Your auto loan payoff calculator shows what’s possible with determination. Now you have the knowledge and tools to succeed. Take that first step today toward financial freedom. Your future debt-free self will be incredibly grateful forever.